Data science implications of a second gilded age

Wirestock on Freepick

Mark Twain coined the time interval The Gilded Age when he printed his 1873 novel The Gilded Age: A Story of At current. Between 1870 and 1914, the US expert an unprecedented amount of enterprise improvement. Plenty of the following wealth accrued to the very best one %.

By means of the primary Gilded Age, the very best ten wealthiest of us throughout the US held a whole of $1.2 trillion (valued in 2006 {{dollars}}), primarily based on Statista. Regular Oil capitalist John D. Rockefeller, the wealthiest man throughout the US, led the very best ten, holding a whole of $305.3 billion.

The Regular Oil Agency perception all through this period turned a near monopoly. Consequently, the Supreme Courtroom docket ordered the dissolution of Regular Oil after a court docket docket case established the company was accountable of anticompetitive practices in 1911. This kind of US authorities perception busting–which moreover included the tobacco, railroads, sugar, and steel industries–launched an end to the Gilded Age by 1914.

One other equally acquainted names on the wealthiest document sooner than the Gilded Age ended embrace steel magnate Andrew Carnegie ($281.2 billion), railroad baron Cornelius Vanderbilt ($168.4), the banking commerce Mellon brothers Andrew and Richard (collectively worth $132.8 billion), and automotive commerce pioneer Henry Ford ($54.3 billion).

The second gilded age

A second gilded age arguably began in 2013, when Jim Cramer, a CNBC investing TV current host, coined the time interval “FAANG” to elucidate the primary tech sector companies of the day: Fb (now Meta), Apple, Amazon, Netflix and Google (now Alphabet).

Apple was the first public US tech agency to attain $1 trillion in market capitalization–in 2018.

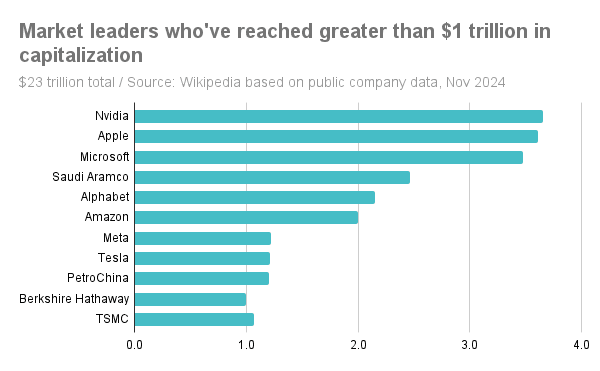

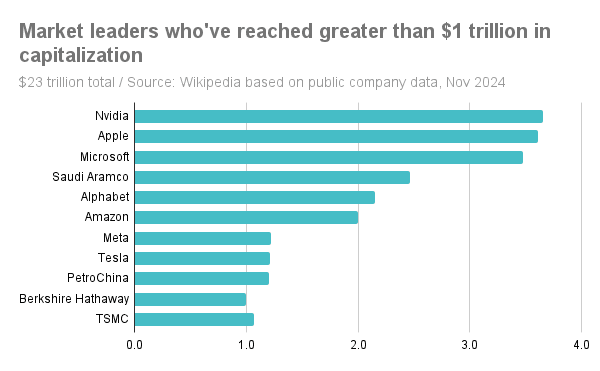

As of November 2024, eleven public companies globally have reached $1 trillion in market capitalization. Three of these–Nvidia, Apple and Microsoft–have even reached over $3 trillion in market cap:

A couple of of those companies are primary or influential in a variety of commerce sectors, not merely experience. Amazon, as an illustration, continues to dominate the retail sector, however moreover has a presence in logistics, telehealth and digital properly being (along with Amazon One Medical and Effectively being State of affairs Packages).

Tesla known as an automotive commerce agency, score second globally (at 13 %) to Chinese language language electrical car maker BYD (at 22 %) in EV market share in 2023, primarily based on Statista. Nevertheless Tesla could not be a market cap chief with out its AI-driven enhancements, along with full self driving and the design of its private AI chips. Taiwan Semiconductor Manufacturing Firm (TSMC), moreover obtainable available on the market cap chief document, manufactures the AI chips Tesla designs, along with Apple’s AI chips.

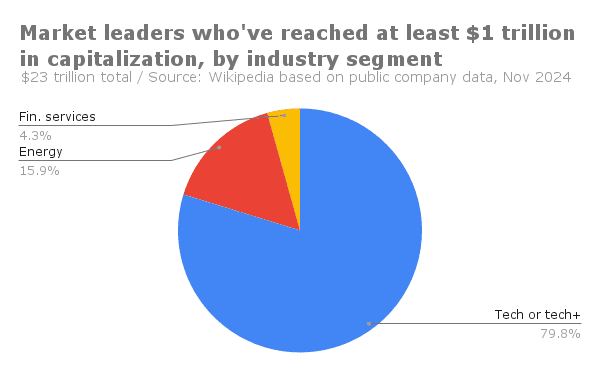

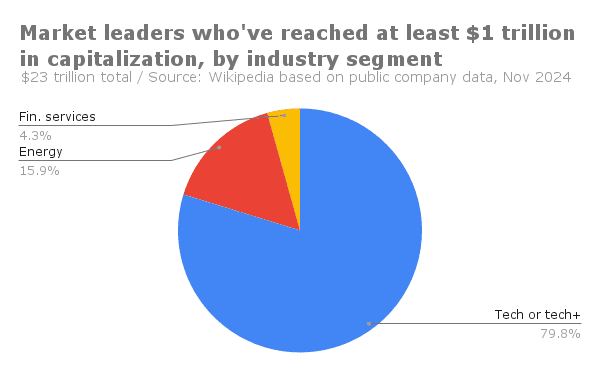

Info-driven, machine-assisted intelligence, whether or not or not it’s probabilistic machine finding out, or deterministic, symbolic and rule-based, or a combination, was primarily answerable for nearly 80 % of the entire of the very best 11 market cap leaders in 2024. Vitality companies rank a distant second by commerce part, making up virtually 16 % of the entire. Financial firms (represented by Berkshire Hathaway alone, which has been investing in tech sector leaders for a number of years now) makes up merely 4.3 % of the entire.

In April 2024, Forbes counted 342 billionaires throughout the tech sector as Forbes defines it, up from 313 in 2023. The very best 5 tech billionaires using Forbes’ commerce segmentation included Jeff Bezos (Amazon–$194 billion in web worth) , Mark Zuckerberg (Meta–$177 billion), Larry Ellison (Oracle–$141 billion), Bill Gates (Microsoft–$128 billion) and Steve Ballmer (Microsoft–$121 billion).

Forbes ranked Elon Musk (with Tesla in automotive, SpaceX in aerospace, Starlink in satellite tv for pc television for laptop net, X in social media, et al.) as a result of the richest explicit particular person on the planet at over $330 billion in web worth as of December. Forbes ranked Larry Net web page (Alphabet–$143 billion) and Sergey Brin (Alphabet–$136 billion) as #7 and #8 on its normal billionaire document.

The very best public cloud suppliers associated to this tech sector billionaire document are moreover among the many many prime ranked hyperscalers, investing primarily probably the most in AI-grade and totally different data center infrastructure. Gartner ranks Amazon with Amazon Internet Suppliers, Microsoft with Azure, Alphabet with GCP, and Oracle with Cloud Infrastructure amongst its prime 5 Strategic Cloud Platform Service suppliers.

Morgan Stanley estimated that hyperscaler capital expenditures in 2025 would attain $300 billion, led by Amazon and Microsoft spending upwards of $90 billion each. (See Only a few enterprise takeaways from the AI {{hardware}} and edge AI summit 2024 at https://www.datasciencecentral.com/a-few-enterprise-takeaways-from-the-ai-hardware-and-edge-ai-summit-2024/ for further information.)

The specter of AI-enabled surveillance capitalism

Monopolistic, anticompetitive habits is probably going one of many hallmarks of any gilded age. Lots of the capital and human property associated to AI innovation and funding are owned and managed by small groups of people. Nevertheless governments throughout the West in 2024 are quite a bit weaker than that they had been throughout the early twentieth century, with solely restricted capability to counter the heightened power of the private sector.

It’s moreover the case {{that a}} concentrated digital market might be further insidious and personally invasive than in the middle of the commercial age. Of their article “Can you perception AI? Proper right here’s why you shouldn’t” printed in The Dialog in November 2024, Harvard’s cybersecurity guru Bruce Schneier and one in every of its data scientists Nathan Sanders used the time interval “surveillance capitalism” to elucidate the current state of non-public sector AI. They underscored the following elements:

- AI platforms, intentionally or not, might be designed to favor the pursuits of builders over that of explicit particular person prospects.

- AI will buy a far more intimate information of a given particular person’s non-public particulars to have the flexibility to behave on the particular person’s behalf. From a security perspective, an individual will subsequently have to perception their non-public assistant. In order to have the flexibility to perception such assistants, prospects “must be constructive the AIs aren’t secretly working for one more particular person.”

- Monopolistic AI homeowners have constructed massive social media and ecommerce subscriber bases by offering “free” or very low worth firms, nevertheless would possibly need to monetize their investments finally.

- For purchasers, there’s no methodology to know correct now if a given bot politically skews its output and even who actually owns the bot. “Most AIs,” the authors say, “fail to regulate to the rising European mandate” of the European Union’s proposed AI act.

The implication considering these realities is that prospects ought to fend for themselves in relation to defending themselves in direction of monopolistic or a minimum of oligopolistic AI for the foreseeable future.